Category: Money

-

Can you save $2550 by carpooling?

•

The week beginning 9 June marks Kiwi Carpooling Week in New Zealand, and Auckland Transport wants to encourage drivers to consider car-pooling as an environment-friendly gesture which also saves money. I asked Auckland Transport – does carpooling really save money? Do they have any numbers to support the claim? Auckland…

-

Want to earn $8000 from home? Get ready to be scammed

•

“A single mother earned $8000 from Google Adsense in one month. Find out how!” says an internet advertisement, targeting unsuspecting prospects. New Zealand is hit by many internet scams, with the latest being ‘work from home‘ or ‘part-time’ job scams, which typically target students or at-home mothers. “If it sounds…

-

NZ job market strong

•

Good news for job hunters and those seeking a change of job. The number of job listings on the Trade Me Jobs site has increased by 21% year-on-year. The website had 50,000 roles listed in the first quarter of 2014. The growth in jobs is in all major locations in…

-

ATM PIN scam hits New Zealand

•

New Zealand Police are warning people to be wary about a scam that involves people being asked to think of a 4-digit number to receive a hamper full of groceries. The victims are people who have had their wallets or purses stolen a few days earlier and unbeknownst to them,…

-

Indian students in US launch website on Lok Sabha elections

•

The ‘FiveFortyFive.com’ is a “single-subject website” focusing on the Indian general elections founded by six Columbia journalism school students.

-

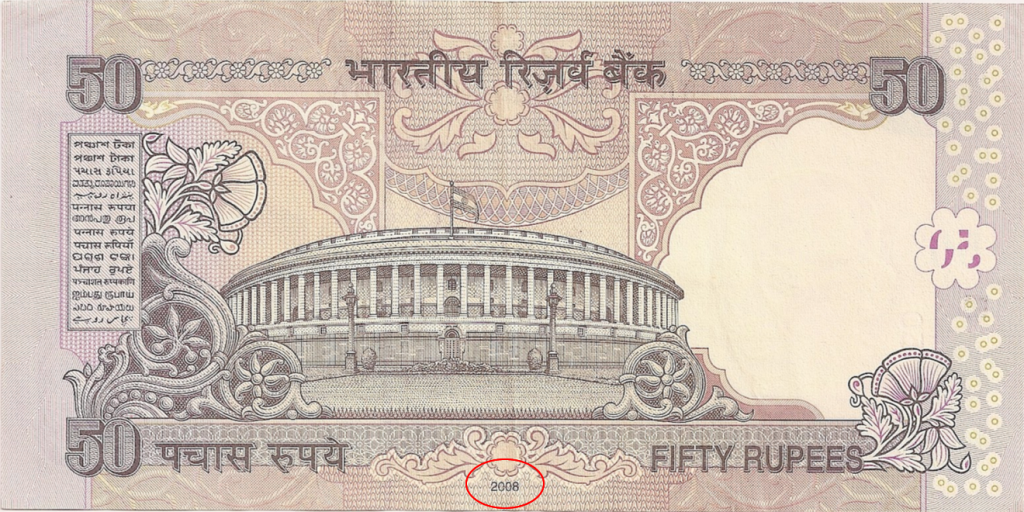

Why RBI is withdrawing pre-2005 notes

•

All Indian currency notes issued before 2005 will soon go out of circulation, as per a new directive issued by the Reserve Bank of India on 22 January 2013. From 1 April 2014, all currency notes issued prior to 2005 will need to be exchanged at any bank in the…

-

401(K) and IRA – should expats invest in retirement plans?

•

Many overseas Indians and expats settled in the United States of America face a common dilemma – should they invest in a 401(K) plan or an IRA (Individual Retirement Account). The confusion is more prominent among non-US citizens or those without permanent residence status in the US. Many Indians working…

-

Kotak Mahindra launches NRI banking with Scotiabank

•

Indians moving to Canada can now experience NRI banking services with another trusted Indian banking brand. For new immigrants, or international students, the latest alliance of Kotak Mahindra Bank with Canada’s Scotiabank opens the doors for financial services at a time when you need those the most – just after arrival in…

-

NRI income tax return: deemed rent

•

NRIs (Non Resident Indians) investing in real estate in India get excited about high returns on property, but don’t consider the NRI Income Tax rules. Filing tax returns are a priority now that the due date for the year 2011-12 is close. NRI Income Tax rules has some strange provisions…

-

India a promising market for exporting polymers – report

•

India’s polymer industry, while growing, still has vast untapped potential, according an industry report. India consumes only 7.4kg of polymer per person every year, much lower than the United States which uses more than 100kg per person annually. Global average is 29kg (2010). Polymer is used in various forms, from…

-

How to repair bad credit rating

•

Credit cards with bad credit rating often cause financial distress, and they often search for credit cards for people with bad credit rating. They are attracted to advertisements that promise ‘no credit check credit cards’. People with bad credit rating are sometimes disadvantaged because they are continuously declined for regular…

-

Should I fix my mortgage or keep it floating?

•

Should I fix my mortgage or keep it floating? Or should I stay with my bank or switch? With ever changing home loan market, finding the most suitable and accurate information from an unbiased source about home loan is very difficult. It gets more confusing when you visit different banks…